Real Estate Investing Tips kicks off with savvy advice for those looking to enter the world of property investments. From lucrative options to essential tips, this guide has it all.

Dive in to discover how to make the most of your money in the real estate market.

Importance of Real Estate Investing

Real estate investing is a smart choice for those looking to build wealth over time. Here are some key reasons why it’s such a lucrative option:

Benefits of Real Estate Investing

- Appreciation: Real estate properties have the potential to increase in value over time, providing a significant return on investment.

- Passive Income: Rental properties can generate a steady stream of passive income, allowing investors to grow their wealth without actively working.

- Tax Advantages: Real estate investors can benefit from tax deductions, such as mortgage interest, property taxes, and depreciation, reducing their overall tax liability.

- Diversification: Real estate investments offer diversification to a portfolio, helping to mitigate risk compared to investing solely in stocks or bonds.

Advantages of Real Estate Investing for Long-Term Financial Growth

- Stable Cash Flow: Rental income from real estate properties can provide a stable cash flow, even during economic downturns.

- Hedge Against Inflation: Real estate values and rental rates often increase with inflation, making it a good hedge against rising prices.

- Equity Build-Up: As tenants pay down the mortgage on a property, the investor’s equity in the property grows, increasing net worth over time.

- Control Over Investment: Real estate investors have more control over their investments compared to other asset classes, allowing them to make strategic decisions to maximize returns.

Types of Real Estate Investments

Investing in real estate offers various opportunities for financial growth and stability. There are different types of real estate investments that investors can consider, each with its own set of benefits and risks.

Residential Real Estate

Residential real estate involves properties such as single-family homes, condos, and apartments that are used for living purposes. Investing in residential real estate can provide a steady income stream through rental payments. Successful strategies in this category include house flipping, where investors purchase properties at a low price, renovate them, and sell for a profit.

Commercial Real Estate

Commercial real estate includes properties used for business purposes, such as office buildings, retail spaces, and warehouses. Investing in commercial real estate can offer higher income potential but also comes with higher risks. Successful strategies in this category include leasing properties to businesses or investing in commercial real estate investment trusts (REITs).

Industrial Real Estate

Industrial real estate consists of properties like factories, warehouses, and distribution centers. Investing in industrial real estate can provide stable long-term income, especially with the rise of e-commerce and logistics. Successful strategies in this category involve investing in industrial properties located in strategic locations with high demand.

Comparison of Risks

Each type of real estate investment comes with its own set of risks. Residential properties may be more susceptible to market fluctuations and tenant turnover. Commercial properties are subject to economic conditions and changes in business trends. Industrial properties face risks related to technological advancements and shifts in supply chain management. It’s important for investors to carefully assess these risks and develop a diversified real estate investment portfolio to mitigate potential losses.

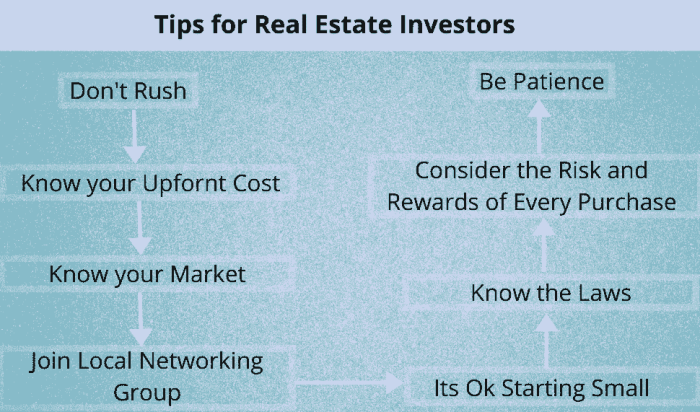

Tips for Beginners in Real Estate Investing: Real Estate Investing Tips

Investing in real estate can be a lucrative venture for beginners, but it’s essential to approach it with caution and knowledge. Here are some tips to help you get started:

Importance of Market Research and Due Diligence

Before diving into real estate investing, it’s crucial to conduct thorough market research and due diligence. This includes analyzing the local real estate market, understanding property trends, and evaluating potential risks and rewards. By doing your homework, you can make informed decisions and minimize the chances of making costly mistakes.

Ways to Mitigate Risks

For beginners, it’s important to take steps to mitigate risks when investing in real estate. Some strategies to consider include:

- Start small: Begin with a modest investment to gain experience and minimize financial exposure.

- Build a reliable team: Surround yourself with professionals such as real estate agents, contractors, and property managers who can provide guidance and support.

- Understand your finances: Have a clear understanding of your budget, expenses, and potential returns to ensure you can afford the investment.

- Consider different investment types: Explore options such as rental properties, fix-and-flip projects, or real estate investment trusts (REITs) to diversify your portfolio and spread out risks.

- Stay informed: Keep up to date with market trends, regulations, and best practices in real estate investing to make informed decisions.

Financing Options for Real Estate Investments

Investing in real estate often requires significant capital, and for many investors, securing financing is a crucial step in acquiring properties. There are several financing options available to investors, each with its own set of pros and cons. Understanding these options and choosing the right one can greatly impact the success of your real estate investments.

Traditional Mortgages, Real Estate Investing Tips

Traditional mortgages are a common financing option for real estate investments. These loans are typically offered by banks and other financial institutions, and they require a down payment and good credit score. The main advantage of traditional mortgages is that they often come with lower interest rates compared to other financing options. However, the application process can be lengthy, and approval may be challenging for some investors.

Hard Money Loans

Hard money loans are another financing option for real estate investments, especially for investors who may not qualify for traditional mortgages. These loans are typically offered by private lenders or investor groups and are secured by the property itself. Hard money loans usually have higher interest rates and shorter terms compared to traditional mortgages, making them more suitable for short-term investment strategies.

The main advantage of hard money loans is the quick approval process, which can be beneficial for investors looking to close deals quickly.

Private Money Lenders

Private money lenders are individuals or companies that provide financing for real estate investments. These lenders offer more flexibility in terms of loan terms and eligibility requirements compared to traditional mortgages. Private money lenders can be a good option for investors who may not qualify for traditional financing or need more creative financing solutions. However, private money loans often come with higher interest rates and fees compared to traditional mortgages.

Real Estate Crowdfunding

Real estate crowdfunding is a relatively new financing option that allows investors to pool their resources to invest in properties. This option provides a more accessible way for investors to enter the real estate market without the need for large amounts of capital. Real estate crowdfunding platforms connect investors with property developers and projects, offering a range of investment opportunities.

However, investors should carefully research and vet crowdfunding platforms to ensure legitimacy and minimize risks.